LEARN ABOUT OPTIONS TRADING IN INDIA

LEARN ABOUT STOCK OPTIONS AND INDEX OPTIONS

1. Types of options

2. Why trade options?

3. What instruments can be traded?

4. Some types of Option strategies

5. How options are priced?

6. How to evaluate different option trades?

7. An idea about expected returns from options 1. Types of options

At the basic level, there are 2 types of options:

a) Call option (CE) - In simple terms, you buy call if bullish or sell call if bearish.

b) Put option (PE) - Again simply put, you buy put if bearish or sell put if bullish.

More specifically, this is what can be done depending on view on underlying stock:

a) Stock expected to rise in short term - Buy call.

b) Stock expected not to fall below a certain level - Sell puts of strike level below which you don't expect it to fall.

c) Stock not expected to rise above a certain level - Sell calls of strike level above which you don't expect stock to rise.

d) Stock expected to fall - Buy puts. Now, what is stated in above 4 points, form the basic building blocks of 100s of option strategies for e.g. if you expect stock to be range bound you can initiate a 'Short Straddle' or 'Short Strangle' (you sell both call & put).

some details about some strategies in 3rd section.

Based on option price w.r.t price of underlying stock/index, there are 3 types of options:

a) OTM - Out of money options - e.g. if NIFTY is trading at 5317 currently, all CE's above strike of 5300 i.e. 5400, 5500, 5600 etc are OTM options. Similarly all puts below 5300 are OTM.

b) ATM - At the money - Options where strike price is same as price of underlying stock/index. e.g. Coal India is trading at about 340. So, 340 CE & PE are ATM options.

c) ITM - In the money - These are CE's where strike is below spot (spot is current price of underlying stock/index) or PE's where strike is above spot e.g. all CE's below 5400 are ITM.

2. Why trade Options?

One advantage of option trading as compared to stock trading is the amount of flexibility, you have lots of option strategies to make money in any kind of market -

a) Stocks going up

b) Stocks going down

c) Stocks remaining stagnant or range bound

(These have been my favorites over last 1 year or so!) Another advantage is that your money is always liquid. This being a long term investment group, this may not be a consideration for people, but to make money from stocks, you need to block your capital for comparatively longer period of time.

Whereas, in options, mostly trades are held maximum till expiry of current month, which is last Thursday of every month. So, you make money without really blocking your capital.

Disadvantage of option trading as compared to stocks:

There is no free lunch!!

Higher returns came at the cost of higher risk.

Derivatives are complex structures & proper risk management needs to be in place. So, expectedly, you need to have a good knowledge about the nature of stock movement, this is where knowledge of technicals come into picture. For example for case

(c) of making money from range bound stocks, following technical characteristics can be used:

a) See if price is oscillating within a channel i.e. not really trending in up or down direction.

b) Momentum indicators like RSI or directional indicators like ADX can give an idea if stock is trending or not.

c) Check support/resistance levels, moving averages etc.

d) Option chain (can be checked at NSE's website - http://www.nseindia.com/live_

So, OI gives indications in addition to the technicals checked earlier. But please note that these are just indicative, nothing more. If we look at Option Chain for NIFTY for this month, support comes at 5200 & resistance is at 5600 as these have highest OI build up for puts & calls respectively .

3. What instruments can be traded?

All FNO stocks & major indices like NIFTY, BANKNIFTY etc can be traded.

But in Indian stock market, most of the stock options are illiquid & hence pose a big risk of getting stuck in case stock makes an unfavorable movement.

So, always trade in liquid options.

Some of the stocks which are amply liquid are - Reliance, Bharti, DLF, Coal India, Infy, Tata Steel etc.

Out of some 200 FnO stocks, there are about 40-45 stocks where current month options are reasonably liquid.

So, do not trade outside of these instruments.

NIFTY is a great instrument for options trading for following reasons:

a) Highly liquid.

b) Huge option of strikes (5300, 5400, 5500 etc) available which can be used in different option strategies.

c) Even options of next few months are reasonably liquid which can be used in strategies like Calendar Spreads where you combine options of this month & next month expiries.

4. Some types of Option Strategies There are many option strategies to pick from, depending on your view about the underlying.

Just to give an idea how strategies can be picked based on view on underlying, HERE some simple strategies:

a) Short Straddle - Sell both calls & puts of same strike.

Here we expect stock to remain stagnant or within a small range. Let us again take example of CoalIndia.

It is trading at 342. Its 340 CE for current expiry is trading at 8.2 & 340 PE is trading at 5.05.

We sell both call & put & get a total premium of 8+5=Rs 13. If CoalIndia remains at 340, our profit is Rs 13000 per lot (Coal India has a lot size of 1000).

Also, if Coal India remains between 340 - 13 & 340 + 13 i.e. between range 327 - 353, we'll make some profit.

b) Short Strangle - Sell call & put of different strikes - If we expect range for CoalIndia to be 320-360 from today till expiry (29th March), sell 320 CE & 360 PE. If CoalIndia indeed stays between this range for next 2 weeks, our profit will be Rs 3000 per lot (Rs 2 from 360 CE + Rs 1 from 320 PE).

C) Bull Spread - Here buy a CE & sell CE of a higher strike - This is for stocks where we feel stock will have a spurt of 5-10%.

So, we can buy a ATM CE & sell higher OTM CE. e.g. if we will DishTV can move up to 60 from here before expiry, we can buy 55 CE for Rs 2 & sell 60 CE for Rs 0.85. So, our net outflow is Rs 1.15 per lot.

This means that we'll make guaranteed money if DishTV closes above 55+1.15 = 56.15 before expiry. Also, Rs 1.15 per lot is the maximum loss that we can have.

d) Bear Spread - Similar to Bull Spread, but here view is bearish & we create a spread with puts.

e) Long Straddle/Strangle - Here we buy both CE & PE expecting a big move in either direction but we're not sure of the direction of move.

For e.g. just before budget, one can initiate a long straddle/strangle if we believe if market will make a decisive move based on budget announcements.

5. How options are priced? Option premium/price consists of 2 parts: a) Intrinsic value - Represents "money-ness" of options

(This can be compared with 'Book Value' in case of stocks :)).

b) Time value Let us take example of NIFTY 5300 CE for current month, trading at 61 (as of 18/3), whereas NIFTY is at 5318.

In this case, out of Rs 61, Rs 18 (5318 - 5300) is intrinsic value & Rs 43 (61 - 18) is time value premium. It is very important to note that by the expiry, every option value is same as its intrinsic value i.e. its time value premium becomes 0.

So, if NIFTY closes at 5318 by expiry, 5300 CE will close at Rs 18. 5400 CE will close at 0. Now next obvious question is how time value premium is determined.

This is where 'Option Greeks' come into picture.

Following greeks are the factors that determine time value premium:

a) Delta - Delta represents correlation of option price with price of underlying. Delta is different for OTM, ATM & ITM options.

b) Vega - This represents correlation with volatility. Higher the volatility, higher will be contribution to time value premium.

c) Theta - This represents decay in the time value premium with time. Remember by the expiry, time value premium will become zero. So, this determines how it will converge to zero provided other greeks do not change.

d) Gamma - Represents acceleration There is also Implied Volatility (IV) that is evaluated from current option price. It can be compared with historical volatility to get an idea about the option valuation.

(similar to way we compare current P/E with historical P/E of a stock :))

You don't really need to get into greeks (except theta) when it comes to option trading in "stocks". But vega is really important.

For NIFTY, use VIX (available on NSE website) for vega. Higher VIX means higher option premiums. So, when VIX is high, it is a good time to write options provided you are confident about short term support/resistance levels of NIFTY.

6. How to evaluate different option trades?

Consider following before initiating any option trade:

a) Investment required incase of a Debit strategy i.e. you are buying an option

. b) Maximum profit potential - This is limited incase an option is sold for e.g. if you sell CoalIndia 320 PE @ 1.1, Rs 1100 is your maximum profit potential per lot.

c) Maximum loss risk - Incase option is bought, premium paid is the maximum loss. But if option is sold, loss can be the theoretically unlimited!

d) Breakeven point - Again lets say you buy CoalIndia 340 CE option @ Rs 8.2 assuming a bullish view. In this case, breakeven occurs at 348.2.

So, you'll make money only if CoalIndia closes above 348.2 by expiry.

e) Return if stock price remains unchanged

7. An idea about expected returns from options

one can make consistently returns of 5-6% per month trading "full time". If compounded annually over 12 months, this translates into annual returns of about 100%. I don't trade full time due to my hectic job but manage to generate positive cash flow whenever I've time to trade. Of course, derivative trading also has its own risks & it can cause huge loses if not properly managed. So, risk management & money management are most important aspects as with normal stock trading. Let me take a simple example of naked put writing trade (naked writing is risky for beginners!) to illustrate how monthly returns of 5-6% can be generated. Consider NIFTY currently at 5318. Now, it is a reasonable view that NIFTY will not go below 5100 by expiry (which is 9 trading sessions away)? So, one call sell 5100 PE which is currently trading at Rs 23.45. So, if NIFTY closes above 5100 by expiry, this sold put will reduce to zero & money made per lot would be 23.45 x 50 = Rs 1172. Margin requirement per lot for writing 5100 PE is Rs 18354 (Please note that margin needs to be blocked for option writing). So, percentage returns in this trade = 1172 / 18354 = 6.3%. So, in 9 days you can make maximum of 6.3% profit. Also, since you get a premium of 23 by selling 5100 PE, means you will start making loss if NIFTY closes below 5100 - 23 = 5077 by expiry.

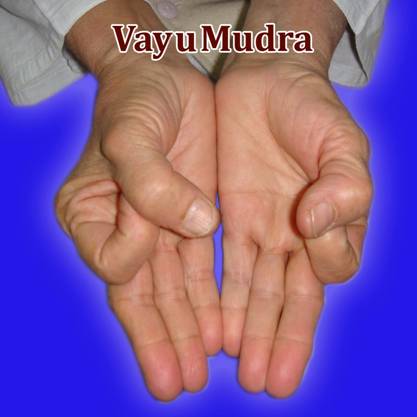

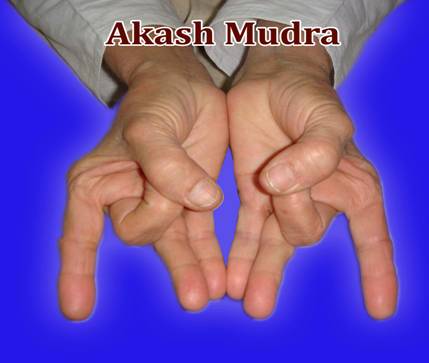

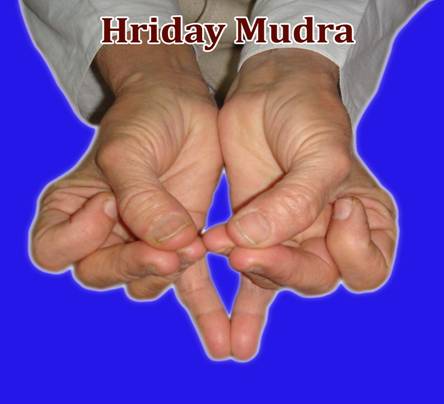

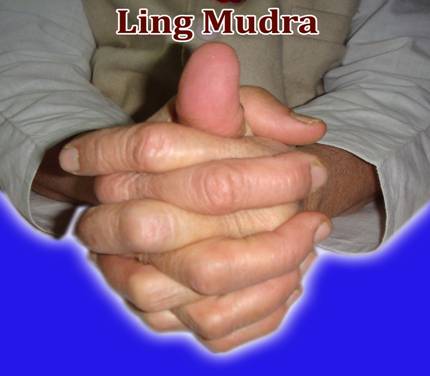

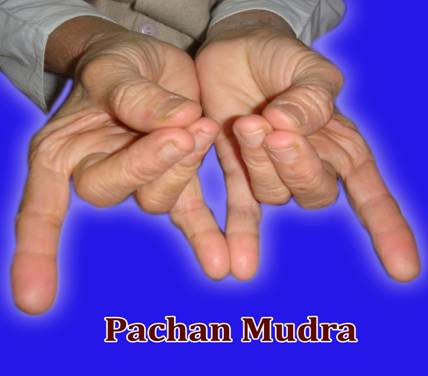

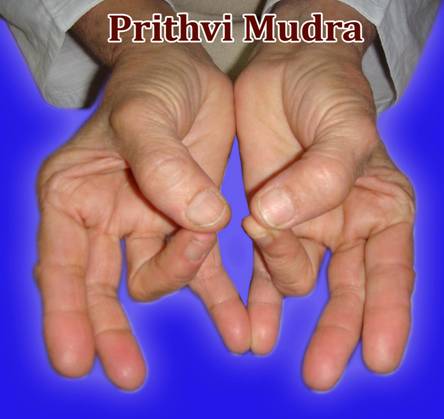

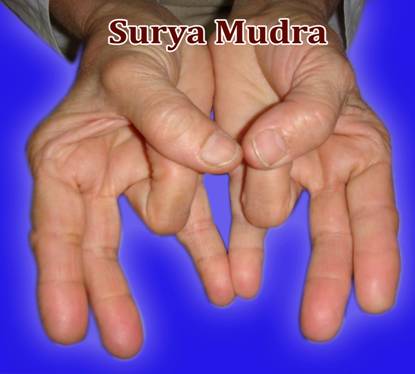

Mudras

are all about the fingers, and each finger is packed with nerve

endings, energy and a meaning all its own. The correct play of the

fingers gives the Mudra the potency to heal. Let us take a look at the

five fingers:

Mudras

are all about the fingers, and each finger is packed with nerve

endings, energy and a meaning all its own. The correct play of the

fingers gives the Mudra the potency to heal. Let us take a look at the

five fingers: