NSE Ticker

Sunday, September 28, 2014

Trading Stocks and Options

Trading Stocks and Options blindly without a Monthly Plan of Profit or Loss IS LIKE KEEPING YOUR HANDS IN HOT BOILING WATER.

WHAT IS THE PLAN: WHAT SHOULD BE THE PLAN :

1) HOW MUCH PAIN IS THE REAL PAIN YOU CAN ABSORB IN A MONTH.

2) ARE YOU READY FOR KEEPING YOUR HANDS IN BOILING WATER.

3) CAN YOU STAY EMOTIONLESS - NO STRESS, NO HAPPINESS, NO GREED NO FEAR.

4) HOW MUCH YOU WANT TO EARN MONTHLY

5) HOW MUCH CAPITAL YOU WANT TO INVEST

6) HOW MUCH LOSS CAN YOU BEAR FOR A MONTH

7) ARE YOU TRADING WITH YOUR FULL CAPITAL? JUST THINK ABOUT IT.

8) ONLY 10% OF YOUR CAPITAL MUST BE INVESTED EVERY MONTH.

9) WHAT IS THE TIME HORIZON YOU ARE FOLLOWING WHILE TRADING INTRADAY

10) ARE YOU USING ANY TECHNICAL INDICATIORS - MOVING AVERAGES ETC.

FIND ANSWERS FIRST, THEN TAKE A PAPER, PUT THE SAME ON THE DESK WHILE TRADING!

WHAT IS THE PLAN: WHAT SHOULD BE THE PLAN :

1) HOW MUCH PAIN IS THE REAL PAIN YOU CAN ABSORB IN A MONTH.

2) ARE YOU READY FOR KEEPING YOUR HANDS IN BOILING WATER.

3) CAN YOU STAY EMOTIONLESS - NO STRESS, NO HAPPINESS, NO GREED NO FEAR.

4) HOW MUCH YOU WANT TO EARN MONTHLY

5) HOW MUCH CAPITAL YOU WANT TO INVEST

6) HOW MUCH LOSS CAN YOU BEAR FOR A MONTH

7) ARE YOU TRADING WITH YOUR FULL CAPITAL? JUST THINK ABOUT IT.

8) ONLY 10% OF YOUR CAPITAL MUST BE INVESTED EVERY MONTH.

9) WHAT IS THE TIME HORIZON YOU ARE FOLLOWING WHILE TRADING INTRADAY

10) ARE YOU USING ANY TECHNICAL INDICATIORS - MOVING AVERAGES ETC.

FIND ANSWERS FIRST, THEN TAKE A PAPER, PUT THE SAME ON THE DESK WHILE TRADING!

Thursday, September 25, 2014

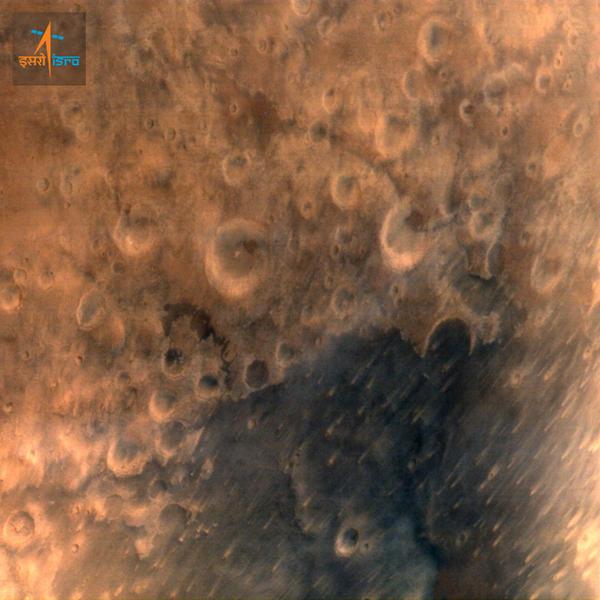

MARS PICTURES FROM ISRO

MARS PICTURES FROM ISRO BRINGS MASS EROSION OF CAPITAL IN 2 DAYS AT

DALAL STREET:

Wednesday, September 24, 2014

Supreme Court cancels 214 coal blocks: Things to know

Supreme Court cancels 214 coal blocks: Things to know

The dreaded judgement is here. The Supreme Court (SC)

on Wednesday cancelled all the coal blocks allocated since 1993. It only

allowed four of the 218 blocks to continue operations.

The order is the latest in the coal-gate scam, which grabbed headlines in March 2012. Here is your six-point cheat sheet on the issue:

What happened in the past: In March 2012, media reports suggested that the Comptroller and Auditor General of India (CAG) had prepared a draft report about losses worth Rs 1.86 lakh crore due to improper allocation of coal blocks. After two complaints by the opposition party Bharatiya Janata Party, the Central Bureau of Investigation (CBI) was directed to investigate if the coal blocks were allocated in legal manner. The Supreme Court too ordered the government last year to cooperate with the CBI.

What the SC had said: In August, the Supreme Court ordered that all the 218 coal block allocations between 1993 and 2010 are illegal. Of these, only 33 coal blocks are currently under production. 19 of these belong to the private sector. The Supreme Court had said that state governments or state PSUs were not eligible to mine coal for commercial purposes; only the central government or PSUs could do that. This is why it allowed four blocks to continue operations. These belong to Ultra Mega Power Projects (UMPP) and are run only by the central government.

What it has ruled now: The SC heard arguments from September 1 on whether these licenses should be cancelled. The Centre had requested the SC to allow the coal blocks that have already started or are nearing production. Meanwhile, the affected companies – coal miners and power producers – argued that the cancellation should be decided on a case-by-case manner. They also reiterated that stakes were high as a lot of money was invested in the mines. However, the Supreme Court has finally ruled that the companies will have to give up their coal blocks. It has also imposed a penalty of Rs 295 per tonne for all the coal that has been mined. This is expected to amount to Rs 8,000-10,000 crore.

Why has it said that: The apex court deemed that successive governments allocated the coal blocks in a non-transparent and unfair manner. Under the Coal Mines Nationalization Act of 1973, Coal India had the monopoly on coal production. An amendment in 1976 allowed producers of iron, steel, cement and power to mine coal blocks. Any coal produced would be used by the same company. This is called captive mining. However, the allocation of these coal blocks was random, and not through an auction. According to the Supreme Court, no objective criteria were followed by the government to decide if the applicants were actually eligible for the coal block.

What next: The cancellation is said to be effective by March 2015. Once the companies let go of the mines, Coal India Ltd will have to take over the blocks. The government can also conduct fresh round of auctions to allocate these mines again.

Companies most affected:

Jindal Steel and Power gets hurt the most by this judgment, according to a report by Macquarie Capital Securities, a brokerage firm. Its earnings per share (EPS) may fall as much as 29%, a report by Morgan Stanley suggested earlier.

The other companies that will be most affected are Hindalco and Sesa Sterlite. Their profitability will be impacted, according to Macquarie. However, power companies dependent on the mines for coal may not be much affected as they can still get the coal supply from the state run Coal India.

Monday, September 22, 2014

Falling crude prices helps India control fiscal deficit

Falling crude prices helps India control fiscal deficit

By Manoj Kumar

NEW DELHI

Mon Sep 22, 2014 3:16pm IST(Reuters) - The finance ministry is increasingly optimistic that it can meet a tough fiscal deficit target, helped by a 12 percent decline in global crude oil prices since Prime Minister Narendra Modi took charge in May.

Lower crude prices mean less government outlay for India, which imports 80 percent of its oil needs - at a cost of $168 billion last year - and subsidizes oil products such as diesel and fertilizer.

"If crude prices remain below $100 a barrel compared with budgeted estimate of $105-$110 a barrel, total oil and fertiliser subsidies would be substantially lower," said a senior finance ministry official, with the direct knowledge of the matter.

Moody's last week lowered the price assumptions it uses for rating purposes on Brent crude oil to $90 per barrel through 2015, which represents a $5 drop from its previous assumptions for 2015.

Finance Ministry and Reserve Bank of India officials are due to meet on Friday to decide how much the government will need to borrow from the markets in the second half of the 2014/15.

The government borrowed 160 billion rupees less than it budgeted in the first half of the financial year, triggering market speculation that the fiscal deficit could end up even lower than the target of 4.1 percent of GDP.

"As of now, the deficit target remains 4.1 percent," said a finance ministry official, who declined to be named since he was not authorized to speak to the media.

The country's top finance ministry official, Arvind Mayaram, suggested at the weekend that the deficit target could be met without the harsh expenditure cuts that have kept the deficit in check in the past two financial years.

"You cannot have three years of continuous expenditure cuts," Mayaram told the Economic Times newspaper in Cairns, Australia, where he attended the G20 meeting. Many economists say the cuts have slowed economic growth.

He said if GDP growth keeps to the pace of the first quarter and remains at 5.6 percent to 5.7 percent in the second half, government borrowing could be lower than budgeted, but said it was too early to take such a decision.

A sustained rally in India's stock markets - the Nifty has risen more than 25 percent this year - is adding to optimism in the finance ministry that revenue from the partial privatization of state-run companies such as ONGC (ONGC.NS) and Coal India (COAL.NS) will beat the budget.

RBI governor Raghuram Rajan delivered more good news in the form of a cash dividend of 520 billion rupees from foreign exchange trading operations, about 50 billion rupees higher than expected.

But not all is well. Tax collections have been lower than targeted so far this year - thanks to a muted economic recovery and a drought in some parts of the country that has hurt corporate earnings.

Revenues from indirect taxes - mainly comprising customs, service and factory gate taxes - rose just 4.6 percent during April-August period, far lower than annual target of 20 percent.

(Additional reporting by Rajesh Kumar Singh; Editing by Frank Jack Daniel)

Friday, September 19, 2014

Yahoo is in line to make anywhere from $8.3 billion to $9.5 billion from the initial public offering of ALIBABA

courtesy : economictimes

SAN FRANCISCO: Yahoo is making amends for years of blundering with one smart move: an early investment in China's Alibaba Group that has turned into a multibillion-dollar boon. The latest windfall will be delivered with Alibaba's record-setting IPO completed late Thursday, which is expected raise up to $25 billion for the e-commerce company and its early backers. Alibaba's shares will begin trading for the first time on Friday on the New York Stock Exchange.

Yahoo is in line to make anywhere from $8.3 billion to $9.5 billion from the initial public offering, depending on whether investment bankers exercise their right to buy additional stock in the deal. The payoff supplements the $7.6 billion jackpot that Yahoo collected two years ago after selling another chunk of its Alibaba holdings and reworked a licensing agreement with the Chinese company.

Even if Yahoo ends up selling its maximum allotment of 140 million shares in the IPO, the Sunnyvale, California, company will still retain a roughly 16 percent stake in Alibaba Group Ltd. worth another $26 billion to $27 billion.

Not a bad return, considering Yahoo acquired its Alibaba stake for $1 billion in 2005 in a deal engineered by company co-founder Jerry Yang and former CEO Terry Semel.

The Alibaba investment has helped ease the pain of Yahoo's struggles in Internet advertising, the heart of its business. Yahoo's annual revenue has slipped from a peak of $7.2 billion to projected $4.5 billion this year, a decline of nearly 40 percent.

Wall Street's exasperation with Yahoo's financial malaise caused the company's stock to sink below $9 in late 2008. The company's stock is now hovering around $43, a level that hasn't been touched since 2006. Most of the comeback occurred during the last two years as investors latched on to Yahoo's stock to profit from Alibaba's success leading up to the IPO.

Yahoo now must decide what to do with the money that will pour in from Alibaba's IPO. Mayer has promised that at least half the amount, after taxes, will be returned to shareholders through dividends or, more likely, buying back stock. That leaves open the possibility that Yahoo might use the rest of the money from the Alibaba IPO to help finance an acquisition of another Internet company such as AOL Inc. or a hot startup such as social media company Pinterest in its latest attempt to revive it.

SAN FRANCISCO: Yahoo is making amends for years of blundering with one smart move: an early investment in China's Alibaba Group that has turned into a multibillion-dollar boon. The latest windfall will be delivered with Alibaba's record-setting IPO completed late Thursday, which is expected raise up to $25 billion for the e-commerce company and its early backers. Alibaba's shares will begin trading for the first time on Friday on the New York Stock Exchange.

Yahoo is in line to make anywhere from $8.3 billion to $9.5 billion from the initial public offering, depending on whether investment bankers exercise their right to buy additional stock in the deal. The payoff supplements the $7.6 billion jackpot that Yahoo collected two years ago after selling another chunk of its Alibaba holdings and reworked a licensing agreement with the Chinese company.

Even if Yahoo ends up selling its maximum allotment of 140 million shares in the IPO, the Sunnyvale, California, company will still retain a roughly 16 percent stake in Alibaba Group Ltd. worth another $26 billion to $27 billion.

Not a bad return, considering Yahoo acquired its Alibaba stake for $1 billion in 2005 in a deal engineered by company co-founder Jerry Yang and former CEO Terry Semel.

The Alibaba investment has helped ease the pain of Yahoo's struggles in Internet advertising, the heart of its business. Yahoo's annual revenue has slipped from a peak of $7.2 billion to projected $4.5 billion this year, a decline of nearly 40 percent.

Yahoo

has gone through seven different CEOs since 2006, including current

leader Marissa Mayer, trying to figure out how to rejuvenate its growth.

Yahoo has gone through seven different CEOs since 2006, including current leader Marissa Mayer, trying to figure out how to rejuvenate its growth. Wall Street's exasperation with Yahoo's financial malaise caused the company's stock to sink below $9 in late 2008. The company's stock is now hovering around $43, a level that hasn't been touched since 2006. Most of the comeback occurred during the last two years as investors latched on to Yahoo's stock to profit from Alibaba's success leading up to the IPO.

Yahoo now must decide what to do with the money that will pour in from Alibaba's IPO. Mayer has promised that at least half the amount, after taxes, will be returned to shareholders through dividends or, more likely, buying back stock. That leaves open the possibility that Yahoo might use the rest of the money from the Alibaba IPO to help finance an acquisition of another Internet company such as AOL Inc. or a hot startup such as social media company Pinterest in its latest attempt to revive it.

Yahoo

now must decide what to do with the money that will pour in from

Alibaba's IPO. Mayer has promised that at least half the amount, after

taxes, will be returned to shareholders through dividends or, more

likely, buying back stock. That leaves open the possibility that Yahoo

might use the rest of the money from the Alibaba IPO to help finance an

acquisition of another Internet company such as AOL Inc. or a hot

startup such as social media company Pinterest in its latest attempt to

revive it ..

Yahoo

now must decide what to do with the money that will pour in from

Alibaba's IPO. Mayer has promised that at least half the amount, after

taxes, will be returned to shareholders through dividends or, more

likely, buying back stock. That leaves open the possibility that Yahoo

might use the rest of the money from the Alibaba IPO to help finance an

acquisition of another Internet company such as AOL Inc. or a hot

startup such as social media company Pinterest in its latest attempt to

revive it ..

SAN

FRANCISCO: Yahoo is making amends for years of blundering with one

smart move: an early investment in China's Alibaba Group that has turned

into a multibillion-dollar boon.

The latest windfall will be delivered with Alibaba's record-setting IPO completed late Thursday, which is expected raise up to $25 billion for the e-commerce company and its early backers. Alibaba's shares will begin trading for the first time on Friday on the New York Stock Exchange.

Yahoo is in line ..

The latest windfall will be delivered with Alibaba's record-setting IPO completed late Thursday, which is expected raise up to $25 billion for the e-commerce company and its early backers. Alibaba's shares will begin trading for the first time on Friday on the New York Stock Exchange.

Yahoo is in line ..

Gates Foundation announces $ 7 lakh towards J&K flood relief

Gates Foundation announces $ 7 lakh towards J&K flood relief

By PTI | 19 Sep, 2014, 06.10PM IST

NEW DELHI: American business tycoon and philanthropist Bill Gates, co-chair of the Bill and Melinda Gates Foundation today announced an emergency relief fund of $ 700,000 for the flood victims of Jammu and Kashmir.

The help came in response to a request from Minister of State for Personnel Jitendra Singh, who hails from Jammu and Kashmir. The announcement was made by Gates when he called on Singh here to discuss mutually shared areas of interest. Singh and Gates talk about shared areas of focus, including the existing Memorandum of Understanding between the Foundation and the Department of Biotechnology/Biotechnology Industry Research Assistance Council ( BIRAC) for their Grand Challenges initiative.

The Foundation's Grand Challenges in Global Health initiative fosters scientific and technological innovation to solve key health problems in the developing world. This initiative promotes Indian innovations in the areas such as sanitation and malnutrition, to help all children survive, thrive and reach their full potential, an official release said. "I share the minister's belief in the power of technology to change the world and I applaud his commitment on harnessing the power of Indian innovation to save lives, through initiatives such as Reinvent The Toilet Challenge: India," Gates said.

By PTI | 19 Sep, 2014, 06.10PM IST

NEW DELHI: American business tycoon and philanthropist Bill Gates, co-chair of the Bill and Melinda Gates Foundation today announced an emergency relief fund of $ 700,000 for the flood victims of Jammu and Kashmir.

The help came in response to a request from Minister of State for Personnel Jitendra Singh, who hails from Jammu and Kashmir. The announcement was made by Gates when he called on Singh here to discuss mutually shared areas of interest. Singh and Gates talk about shared areas of focus, including the existing Memorandum of Understanding between the Foundation and the Department of Biotechnology/Biotechnology Industry Research Assistance Council ( BIRAC) for their Grand Challenges initiative.

The Foundation's Grand Challenges in Global Health initiative fosters scientific and technological innovation to solve key health problems in the developing world. This initiative promotes Indian innovations in the areas such as sanitation and malnutrition, to help all children survive, thrive and reach their full potential, an official release said. "I share the minister's belief in the power of technology to change the world and I applaud his commitment on harnessing the power of Indian innovation to save lives, through initiatives such as Reinvent The Toilet Challenge: India," Gates said.

malnutrition, to help all children survive, thrive and reach their full potential, an official release said.

"I share the minister's belief in the power of technology to change the world and I applaud his commitment on harnessing the power of Indian innovation to save lives, through initiatives such as Reinvent The Toilet Challenge: India," Gates said.

"I share the minister's belief in the power of technology to change the world and I applaud his commitment on harnessing the power of Indian innovation to save lives, through initiatives such as Reinvent The Toilet Challenge: India," Gates said.

NEW

DELHI: American business tycoon and philanthropist Bill Gates,

co-chair of the Bill and Melinda Gates Foundation today announced an

emergency relief fund of $ 700,000 for the flood victims of Jammu and

Kashmir.

The help came in response to a request from Minister of State for Personnel Jitendra Singh, who hails from Jammu and Kashmir.

The announcement was made by Gates when he called on Singh here to discuss mutually shared areas of interest.

Singh and Gates talk ..

The help came in response to a request from Minister of State for Personnel Jitendra Singh, who hails from Jammu and Kashmir.

The announcement was made by Gates when he called on Singh here to discuss mutually shared areas of interest.

Singh and Gates talk ..

Gates Foundation announces $ 7 lakh towards J&K flood relief

By PTI | 19 Sep, 2014, 06.10PM IST

Tuesday, September 16, 2014

Dollar Trades Near 6-Year High Versus Yen as Fed Begins Meeting

Dollar Trades Near 6-Year High Versus Yen as Fed Begins Meeting

The dollar traded near the highest

in six years versus the yen as investors weighed the timing for

the Federal Reserve’s first interest-rate increase since 2006

before policy makers begin a two-day meeting today.

A gauge of the U.S. currency against its major counterparts was near a 14-month high. Japan’s currency rallied briefly today against the greenback as a technical indicator signaled recent losses were excessive. Australia’s dollar fell along with Asian stocks, reversing earlier gains that came after minutes of the Reserve Bank’s September policy meeting said interest rates should remain stable. The pound weakened versus most peers before Scotland votes on its independence this week.

“We’re still looking for a stronger and supported U.S. dollar over time,” said Emma Lawson, a senior currency strategist at National Australia Bank Ltd. in Sydney. “You are seeing a general pickup in economic growth.”

The dollar was unchanged at 107.19 yen as of 6:47 a.m. in London after falling as much as 0.2 percent. It touched 107.39 on Sept. 12, the highest since September 2008. The dollar was little changed at $1.2942 per euro after climbing 0.2 percent yesterday. The yen traded at 138.73 per euro from 138.70. Japan’s markets reopened today after a holiday yesterday.

The Bloomberg Dollar Spot Index, which tracks the greenback against 10 major currencies, was little changed at 1,050.83 after rising to 1,052.14 yesterday, the highest since July 2013.

Reports this month showed manufacturing and services growth in the world’s biggest economy accelerated in August, while the trade deficit narrowed in July.

The 14-day relative strength index for the yen versus the dollar was at 19, below the 30 level that signals to some traders an asset has fallen too far, too fast, and may be due to reverse course.

“Dollar-yen has had a very strong rally on the back of very hawkish expectations from the FOMC this week,” said Sue Trinh, a senior currency strategist at Royal Bank of Canada in Hong Kong. “It looks like consolidation ahead of the FOMC,” she said, referring to the Federal Open Market Committee.

The dollar has risen 3.5 percent in the past month, the best performer among 10 developed-nation currencies tracked by Bloomberg Correlation-Weighted Indexes. The yen has fallen 1.8 percent, the biggest decline within the gauges. The euro has lost 0.5 percent.

The Aussie weakened as a decline in equities sapped demand for higher-yielding assets. The MSCI Asia Pacific Index of shares lost 0.3 percent.

Minutes published today of the Reserve Bank of Australia’s Sept. 2 meeting, when it kept the benchmark rate at 2.5 percent for a 12th-straight gathering, showed policy makers “considered that the most prudent course was likely to be a period of stability in interest rates.”

The Aussie fell 0.2 percent to 90.08 U.S. cents after climbing as much as 0.3 percent. It declined yesterday to 89.84, the lowest since March.

The pound held a loss from yesterday before Scotland’s Sept. 18 referendum on its independence.

Scotland’s nationalists have a 45 percent chance of winning the referendum this week and there’s a risk of a capital flight from the country if that happens, according to a Bloomberg survey of economists.

Sterling slipped 0.1 percent to $1.6219 from $1.6233 yesterday, when it dropped 0.2 percent.

To contact the reporter on this story: Kristine Aquino in Singapore at kaquino1@bloomberg.net

To contact the editors responsible for this story: Garfield Reynolds at greynolds1@bloomberg.net Naoto Hosoda, Jonathan Annells

A gauge of the U.S. currency against its major counterparts was near a 14-month high. Japan’s currency rallied briefly today against the greenback as a technical indicator signaled recent losses were excessive. Australia’s dollar fell along with Asian stocks, reversing earlier gains that came after minutes of the Reserve Bank’s September policy meeting said interest rates should remain stable. The pound weakened versus most peers before Scotland votes on its independence this week.

“We’re still looking for a stronger and supported U.S. dollar over time,” said Emma Lawson, a senior currency strategist at National Australia Bank Ltd. in Sydney. “You are seeing a general pickup in economic growth.”

The dollar was unchanged at 107.19 yen as of 6:47 a.m. in London after falling as much as 0.2 percent. It touched 107.39 on Sept. 12, the highest since September 2008. The dollar was little changed at $1.2942 per euro after climbing 0.2 percent yesterday. The yen traded at 138.73 per euro from 138.70. Japan’s markets reopened today after a holiday yesterday.

The Bloomberg Dollar Spot Index, which tracks the greenback against 10 major currencies, was little changed at 1,050.83 after rising to 1,052.14 yesterday, the highest since July 2013.

Fed Bets

Fed funds futures data compiled by Bloomberg showed traders saw a 78 percent chance yesterday U.S. policy makers will raise the target for overnight loans between banks by their September 2015 meeting, up from 73 percent on Sept. 1. The rate has been in a range of zero to 0.25 percent since December 2008.Reports this month showed manufacturing and services growth in the world’s biggest economy accelerated in August, while the trade deficit narrowed in July.

The 14-day relative strength index for the yen versus the dollar was at 19, below the 30 level that signals to some traders an asset has fallen too far, too fast, and may be due to reverse course.

“Dollar-yen has had a very strong rally on the back of very hawkish expectations from the FOMC this week,” said Sue Trinh, a senior currency strategist at Royal Bank of Canada in Hong Kong. “It looks like consolidation ahead of the FOMC,” she said, referring to the Federal Open Market Committee.

Forecasts Raised

JPMorgan Chase & Co. said in a report today it sees the dollar climbing to 109 yen by the fourth quarter, up from a previous forecast of 106. It predicts the euro will rise to 142 yen over the same period, compared with a previous estimate of 138. The median projections in Bloomberg surveys of analysts put the dollar at 106 yen and the euro at 138 yen by Dec. 31.The dollar has risen 3.5 percent in the past month, the best performer among 10 developed-nation currencies tracked by Bloomberg Correlation-Weighted Indexes. The yen has fallen 1.8 percent, the biggest decline within the gauges. The euro has lost 0.5 percent.

The Aussie weakened as a decline in equities sapped demand for higher-yielding assets. The MSCI Asia Pacific Index of shares lost 0.3 percent.

Minutes published today of the Reserve Bank of Australia’s Sept. 2 meeting, when it kept the benchmark rate at 2.5 percent for a 12th-straight gathering, showed policy makers “considered that the most prudent course was likely to be a period of stability in interest rates.”

Aussie Decline

RBA Assistant Governor Christopher Kent said a further decline in the currency would support demand for local producers that compete with imports, in the text of a speech today at the Bloomberg Summit in Sydney.The Aussie fell 0.2 percent to 90.08 U.S. cents after climbing as much as 0.3 percent. It declined yesterday to 89.84, the lowest since March.

The pound held a loss from yesterday before Scotland’s Sept. 18 referendum on its independence.

Scotland’s nationalists have a 45 percent chance of winning the referendum this week and there’s a risk of a capital flight from the country if that happens, according to a Bloomberg survey of economists.

Sterling slipped 0.1 percent to $1.6219 from $1.6233 yesterday, when it dropped 0.2 percent.

To contact the reporter on this story: Kristine Aquino in Singapore at kaquino1@bloomberg.net

To contact the editors responsible for this story: Garfield Reynolds at greynolds1@bloomberg.net Naoto Hosoda, Jonathan Annells

Monday, September 15, 2014

Saturday, September 6, 2014

Rupee to stagnate on dollar rally; yuan to rise slowly - Reuters poll

Rupee to stagnate on dollar rally; yuan to rise slowly - Reuters poll

By Sumanta Dey

BANGALORE

Fri Sep 5, 2014 3:01pm IST(Reuters) - The rupee will likely stagnate over the next year as a U.S. dollar rally gathers steam and the Indian economy at best chugs along, while the Chinese yuan will probably appreciate a little, a Reuters poll found.

The poll of more than 30 currency strategists, conducted this week, predicted one U.S. dollar will fetch 60.50 rupees in a month, 60.30 rupees in six months and 60.82 rupees in a year. The dollar was trading around 60.43 on Friday.

Those predictions are a little more bearish than those in the August survey and come despite the rupee rising over 2 percent and the stock market rallying 28 percent since the start of this year.

"India enjoyed a steady stream of bond inflows in August, almost bursting the foreign investment limit of $25 billion," said Sook Mei Leong, ASEAN head of market research at BTMU in Singapore.

The European Central Bank on Thursday launched a stimulus programme to buy asset-backed securities and covered bonds in the latest attempt to revive the flagging euro zone economy and boost inflation.

Past experience shows that much of this money may eventually flow into emerging markets that offer a better return than the sub one percent yield of benchmark German bunds.

But with rising treasury yields in the U.S., inflows into Indian markets could be smaller this time around as investors flock to America's bond markets.

"Looking ahead towards year-end, portfolio inflows may taper especially with U.S. monetary accommodation ending soon, though it is unlikely to be as negative as that seen last year," Leong added.

From a year earlier, the Indian economy grew 5.7 percent in the quarter ended June, a 2-1/2 year high, breaking above a dominant sub-five percent trend seen in the past two years.

Still, unmet lofty expectations of reforms from the new government have tempered the jubilant optimism that followed Prime Minister Narendra Modi's election victory in May.

While economists are still hopeful the economy is gaining momentum, they agree it would take longer than earlier expected to return to near double-digit growth rate.

Also tempering the rupee's prospects is the U.S. dollar, as a long-anticipated rally is finally taking hold.

The dollar, as measured against a basket of currencies, has gained almost 5 percent since the start of the year on expectations the Federal Reserve will end its stimulus next month. Economists polled by Reuters expect the first rate hike in Q2 2015.

Thursday, September 4, 2014

Putin unveils Ukraine ceasefire plan, France halts warship

Putin unveils Ukraine ceasefire plan, France halts warship

(Reuters) - President Vladimir Putin outlined plans for a ceasefire in eastern Ukraine on Wednesday but Ukraine's prime minister dismissed the proposal, while France expressed its disapproval of Moscow's support for separatist forces by halting delivery of a warship.

After speaking to Ukrainian President Petro Poroshenko by phone, Putin said he believed Kiev and pro-Russian separatists could reach agreement at planned talks in Minsk on Friday.

"Our views on the way to resolve the conflict, as it seemed to me, are very close," Putin told reporters during a visit to the Mongolian capital of Ulan Bator, describing the seven steps he had put forward to secure a resolution to the crisis.

They included separatists halting offensive operations, Ukrainian forces pulling back, an end to Ukrainian air strikes, the creation of humanitarian aid corridors, the rebuilding of damaged infrastructure and prisoner exchanges.

Poroshenko indicated the conversation with Putin had injected some momentum into efforts to end a conflict that has killed more than 2,600 people since April, saying he hoped the "peace process will finally begin" at Friday's talks and that he and Putin had a "mutual understanding" on steps towards peace.

But Prime Minister Arseny Yatseniuk dismissed the plan as a "deception" on the eve of a NATO summit that will discuss Ukraine, adding in a harshly worded statement: "The real plan of Putin is to destroy Ukraine and to restore the Soviet Union."

U.S. President Barack Obama also voiced caution, saying the conflict could end only if Russia stopped supplying the rebels with weapons and soldiers, a charge Moscow has denied.

Visiting the former Soviet republic of Estonia, now in NATO and the European Union, Obama said previous ceasefires had not worked "either because Russia has not been serious about it or it's pretended that it's not controlling the separatists".

In a further sign of the West's growing mistrust and disapproval of Moscow over its conduct in Ukraine, France said it would not go ahead with the planned delivery of the first of two Mistral helicopter carriers to Russia.

Moscow has said scrapping the 1.2 billion-euro ($1.7 billion) deal would harm France more than Russia and the Defence Ministry described the decision as "no tragedy", but the move is likely to anger the Kremlin and underlines Russia's growing isolation over events in Ukraine.

NEW SANCTIONS POSSIBLE

The EU, which has followed Washington in imposing limited economic sanctions on Russia, could agree new moves against Moscow on Friday, hitting the defense and finance sectors.

Indicating European leaders were not impressed by Putin's new proposals, French President Francois Hollande's office said he had reached his decision "despite the prospect of a ceasefire, which has yet to be confirmed and put in place".

The ceasefire proposals had little immediate impact on the ground. Shelling of the rebel-held city of Donetsk continued and grey plumes of smoke poured up from the area that includes the city's airport.

Rebel leaders said they had little faith that Ukrainian forces would observe any truce in a conflict that has left Russia's relations with the West at their worst level since the end of the Cold War more than two decades ago.

"A ceasefire is always good but our main condition still stands - to withdraw Ukrainian troops from our territory. That's the only reasonable way," said Vladimir Antyufeyev, deputy prime minister of the self-proclaimed Donetsk People's Republic.

A truce would provide Poroshenko with some respite to revive a crumbling economy, battered by months of street protests against a president sympathetic to Moscow and then the violence that erupted after his ouster in February, followed by Russia's annexation of Crimea and then prolonged fighting in the east.

A ceasefire may also be more welcome to Poroshenko now because his forces have suffered setbacks in the past week.

Putin is widely thought intent on ensuring Moscow at least continues to have influence in largely Russian-speaking eastern Ukraine after the conflict ends, though fears of a full-scale invasion by Russia remain in Kiev.

WAR GAMES

Putin's spokesman, Dmitry Peskov, sought to address concerns over the ceasefire proposals by saying they did not address the status of the rebel-held areas. Some rebels want unification with Russia, others want more independence inside Ukraine.

Peskov also denied a statement by Poroshenko's office suggesting Putin had agreed a ceasefire. That would imply Moscow was a party to the conflict, and Kiev later amended the wording.

Despite Putin's proposals, the Defence Ministry announced plans for huge military exercises this month by the strategic rocket forces responsible for its long-range nuclear weapons, involving 4,000 troops in south-central Russia.

Obama made clear NATO, which holds a summit in Wales on Thursday and Friday, would not be cowed.

"NATO must make concrete commitments to help Ukraine modernize and strengthen its security forces. We must do more to help other NATO partners, including Georgia and Moldova, strengthen their defenses as well," he said in a speech in the Estonian capital, Tallinn.

(Additional reporting by Gabriela Baczynska in Donetsk, Lidia Kelly, Jason Bush and Mark Trevelyan in Moscow, and Balazs Koranyi, David Mardiste and Steve Holland in Tallinn; writing by Timothy Heritage; editing by Giles Elgood)

Subscribe to:

Posts (Atom)