Monday, September 30, 2013

India’s April-June Current-Account Deficit at $21.77bn

| India Infoline News Service/ Mumbai 17:03 , Sep 30, 2013 | |

|

|

|

India’s current account deficit (CAD) in Q1 of 2013-14 was US$ 21.8bn (4.9% of GDP). It was US$16.9bn (4% of GDP) in Q1 of 2012-13. The trade deficit in Q1 of 2013-14 increased owing to a rise in imports and some decline in merchandise exports. |

|

|

|

|

|

|

|

|

|

|

Factbox: What would happen if the U.S. government shuts down?

Factbox: What would happen if the U.S. government shuts down?

Sun Sep 29, 2013 7:43pm EDT

(Reuters)

- A partial shutdown of the U.S. government will begin at midnight on

Monday if Republicans and Democrats fail to agree on a funding bill.

In a government shutdown, spending for essential functions related to national security or public safety would continue along with benefit programs such as Medicare health insurance and Social Security retirement benefits for seniors.

But civilian federal employees - from people who process forms and handle regulatory matters to workers at national parks and museums - would be furloughed.

The last government shutdown ran from December 16, 1995, to January 6, 1996, putting about 800,000 federal workers on furlough.

Here is a roundup of the expected impact of a shutdown.

FEDERAL WORKERS

Up to 1 million U.S. federal workers could face furloughs without pay beginning on Oct 1.

Most federal agency workers would be furloughed, but a small number of "excepted" employees must continue to work. These include security workers such as air traffic controllers and prison guards. Congressional staffers could work if requested by the lawmaker or committee that employs them.

Congress has previously paid federal workers for their furlough days.

Federal workers could face penalties if they tried to do any work during the furlough.

FINANCIAL MARKET CONSEQUENCES

Apart from potential market swings, companies hoping to raise money in an initial public offering could face delays.

Businesses will still be able to file certain documents to the Securities and Exchange Commission, but the agency said on Friday that processing and approving applications will be discontinued during a shutdown.

"Capital-raising will have a huge hiccup if the SEC shuts down as it has said," said Eric Jensen, a partner with law firm Cooley LLP in Palo Alto, California.

Drug companies waiting for a decision from the Food and Drug Administration could also see delays. The FDA said it would continue "limited activities" related to programs that are paid for by user fees from drug approval applications.

GOVERNMENT CONTRACTORS

A shutdown lasting less than two weeks would not hurt big defense contractors, which can survive temporarily without federal contract payments, said ratings agency Standard & Poor's. But a longer shutdown could weaken the financial profiles and liquidity positions of smaller defense contractors.

"It is felt a heck of a lot more keenly by small contractors," said Bradley Wine, co-chair of Morrison & Foerster's government contracts practice.

MEAT INSPECTORS

Meat inspectors for the U.S. Department of Agriculture, considered necessary to national safety would stay on job.

U.S. ARMED SERVICES

All military personnel would continue in a normal duty status. But a large number of civilian employees would be temporarily furloughed, according to the Pentagon.

Official furlough notices would be issued on October 1 if no agreement to fund the government has been reached.

FEDERAL COURTS

Federal courts will remain open for about 10 business days. By October 15, the Judiciary will need to provide more guidance.

The Supreme Court, which is scheduled to start its fall 2013 session on October 7, declined to comment on whether it has plans for a government shutdown. But a court spokesman noted that in past shutdown situations, the court continued operating as normal.

IRS

The Internal Revenue Service has a major tax due date on October 15 for Americans who got an extension to file their 2012 taxes, which were due on April 15. The IRS will be accepting tax returns and other tax payments during a shutdown, but will suspend many other activities, including audits.

About 90 percent of the IRS's 90,000 workforce would be furloughed, the agency said on Monday, meaning call centers would be closed and audits halted.

HEALTHCARE LAW

President Barack Obama's 2010 healthcare reform law is scheduled to debut on October 1 when people can start shopping for health insurance.

Money to fund implementation of the healthcare law, known as Obamacare, has already been committed.

(Complied by Washington bureau reporters.)

Saturday, September 28, 2013

Obama comes down on side of Singh, Sen and socialism in debate about poverty

Obama comes down on side of Singh, Sen and socialism in debate about poverty

Chidanand Rajghatta, TNN | Sep 28, 2013, 05.22 PM ISTNEW YORK: Derided by critics as a servitor and doormat when it comes to domestic politics, Prime Minister Manmohan Singh has repeatedly shown that he can hold his own when it comes to international relations — bar, some commentators feel, when it comes to Pakistan. On Friday, Singh pushed back against the United States on many fronts, quite perceptively persuading President Obama to accept his view on at least two issues.

The first was the trade and commerce relationship between the two sides that has hit a rough patch lately. Ahead of Singh's visit, US lawmakers and lobbyists acted in tandem to pile up a laundry list of complaints against New Delhi, drumming up a steady refrain that India was reverting to its socialist tendencies, particularly in the light of increased social safety net spending, and setting up roadblocks against foreign (read American) businesses.

Singh was unapologetic about the road he has chosen, telling the US President that "India is a poor country" and his government's basic task is to improve the standard of living of its people and getting rid of mass poverty, ignorance and disease which still afflict millions. "And in that struggle, we want America to stand by our side," Singh said, with Obama seated beside him. He further added that "in the President, the United States has a leader who realizes and recognizes the contribution that a resurgent India can make not only to fighting poverty, but also to global peace and prosperity."

The argument for pro-poor policies evidently made an impression on Obama, who has himself been dubbed a closet socialist. Despite pressure from domestic trade groups, US president did not push back with the counter-argument presented by many economists — most evident in the Bhagwati vs Sen debate in India — that taking care of growth rate is a better way of lifting the poor out of poverty than dole and subsidies.

"India continues to grow at an amazing rate, but as Prime Minister Singh indicates, obviously there are a lot of people in India that are still trapped in poverty," Obama said, seeming to agree with the Manmohan Singh-Amartya Sen-Jean Dreze prescription. "His primary priority has been to alleviate that poverty and give all the people of India opportunity. And we want to make sure that we're strong partners in helping him to realize that vision, because we believe that if there's a strong India that that's good for the world and it's ultimately good for the US."

The other issue where Singh pushed back publicly was Pakistan, where many domestic commentators contend that he has been soft, in part because of sentimental reasons and in part due to US pressure. After Obama spoke of their shared interest in seeing a peaceful reduction of tensions on the subcontinent and thanked the Prime Minister "for what has been a consistent interest in improving cooperation between India and Pakistan," Singh lit into the issue, telling the US President of the "difficulties that we face given the fact that the epicenter of terror still remains focused in Pakistan."

Although he looked forward to meeting with President Nawaz Sharif in New York, he said "expectations have to be toned down given the terror arm which is still active in our subcontinent."

The Indian side reportedly took up this issue strongly during the dialogue in the context of the latest terrorist attack in Jammu & Kashmir and the Pakistan's continued patronage of and payouts to terrorist outfits from public funds, eliciting a commitment from the US side that President Obama will take up the matter with Prime Minister Nawaz Sharif in a frank manner when the latter visits Washington on October 23. The US itself is yet to figure out whether the Pakistani establishment has genuinely re-set its jihadi orientation.

In any case, the exchanges made it almost certain that Singh's meeting with Sharif in New York over the weekend is reduced to a "cap and rollback terrorism" message, although the latter continued to press Pakistan's interest in his UN speech, saying the suffering of the Kashmiri people cannot be brushed under the carpet.

But insofar as US-India is concerned, in public at least, there was no sign of the American hectoring — particularly on trade and commerce — that was expected ahead of the White House engagement given the sour mood on the Hill and on K street in the preceding weeks. Whether it is because of President Obama's very evident deference to the 81-year old prime minister or whether Washington wants to give India breathing space till after its general election is hard to say.

Friday, September 27, 2013

Senate set for key votes to avoid government shutdown

Senate set for key votes to avoid government shutdown

President Obama promoted his healthcare law before new

insurance exchanges open next week.

By Michael A. Memoli

WASHINGTON -- The Senate is

scheduled to vote Friday to send a government-spending bill back to the

House without a provision cutting off funds for President Obama’s healthcare law, putting pressure on the Republican-controlled chamber to act with just days left to avoid a government shutdown.

September 27, 2013, 6:36 a.m.

The series of votes scheduled to begin after noon EDT includes a procedural vote that conservative critics of the law, led by Sen. Ted Cruz (R-Texas), have called their best chance to kill the Affordable Care Act.

Cruz gave a more-than-21-hour filibuster-like speech earlier this week, saying "that is the vote that matters" because 60 votes are required to end debate in the Senate on the House-passed measure, which includes the funding cuts for Obamacare.

Republican leaders in the Senate have said they intend to vote yes, arguing that to do so means they are supporting a proposal to defund the healthcare law.

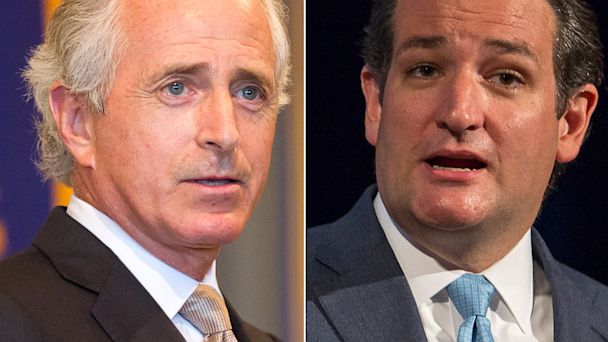

Party divisions over that strategy have largely played out behind closed doors, but spilled into the open Thursday during a rare intraparty debate on the Senate floor. Sen. Bob Corker (R-Tenn.) said Cruz and tea party ally Sen. Mike Lee (R-Utah) were more interested in generating publicity for themselves than supporting an effort to quickly send the bill back to the House, allowing Republicans there time to attach alternative provisions limiting the healthcare law that the Senate could potentially support.

Sen. John McCain (R-Ariz.) said Friday that the battle is "very dysfunctional."

"We are dividing the Republican Party," he said in an interview on "CBS This Morning. "Rather than attacking Democrats and maybe trying to persuade those five or six Democrats who are in states that are leaning Republican, we are now launching attacks against Republicans funded by commercials that Senator Lee and Senator Cruz appear in."

If Congress fails to settle on a plan to keep the government funded by Oct. 1, the start of a new fiscal year, the federal government will see its first shutdown in nearly two decades.

If the Senate, as expected, votes out the spending measure Friday, the focus returns to the House, where another divide among Republicans is playing out.

House GOP leaders have not yet indicated how they will respond to the Senate action. On Thursday, they presented to members a plan for the next fiscal battle -- over whether to raise the nation's debt limit -- but by day's end, it appeared short of the support it would need to pass in the chamber.

Shutdown Forecast: 50-50

Shutdown Forecast: 50-50

Sep 27, 2013 9:02am

By MICHAEL FALCONE (@michaelpfalcone)- LOOKING FOR PROGRESS IN ALL THE WRONG PLACES: On “Good Morning America” today ABC’s JONATHAN KARL put the chances of a shutdown — or a catastrophic default — at 50-50. “As that clock ticks down toward shutdown there is no real sign of progress anywhere,” Karl said. “The chances are getting greater with each passing hour. … Leaders in both parties that I’ve spoken to both think that a shutdown is more likely than not. I would put the odds of a shutdown or default at 50-50 … and I may be being optimistic.”

- WHAT HAPPENS NOW? Around 12:30 p.m. today, the Senate will start its votes and wrap up its work on the amended continuing resolution to keep the government funded, ABC’s ARLETTE SAENZ notes. Senate leadership was able to work out a deal on accelerating the time-frame for a vote to Friday instead of Sunday so the House could have more time to work on a plan. The House will vote on their amended continuing resolution on Saturday or Sunday. But the Senate has warned it will only accept a so-called “clean CR,” something the House has not indicated they will agree to.

- OBAMA — GOP IS TRYING TO ‘BLACKMAIL’ ME: President Obama yesterday accused Republicans of political extortion, saying they are trying to “blackmail a president” by threatening to shut down the government or refuse to raise the debt ceiling unless he agrees to gut his signature health care law, ABC’s MARY BRUCE notes. Making a sales pitch for Obamacare before a crowd of students in Maryland, the president said that critics of the Affordable Care Act have become “more irresponsible” as implementation approaches. “Some have threatened a government shutdown if they can’t shut down this law. Others have actually threatened an economic shutdown by refusing to pay America’s bills if they can’t delay the law. That’s not going to happen as long as long as I’m president,” he said to cheers at Prince George’s Community College. “The Affordable Care Act is here to stay.” http://abcn.ws/1baHwSg

- THIS WEEK ON ‘THIS WEEK’: With a looming government shutdown just days away, GEORGE STEPHANOPOULOS goes one-on-one with former President Bill Clinton on the budget battles in Washington and his latest work with the Clinton Global Initiative, in a Sunday exclusive. And our powerhouse roundtable tackles all the week’s politics, with ABC News political analyst Matthew Dowd, Weekly Standard editor Bill Kristol, New York Times columnist and Nobel Prize-winning economist Paul Krugman, and former Michigan Gov. Jennifer Granholm. Check the “This Week” page for full guest listings. Be sure to use #ThisWeek when you tweet about the program. Tune in Sunday: http://abcnews.go.com/thisweek

GOPers Clash On Senate Floor Over Government Shutdown

GOPers Clash On Senate Floor Over Government Shutdown

Sep 26, 2013 7:19pm

Senate Majority Leader Harry Reid wanted to accelerate consideration of the continuing resolution by setting a vote for Thursday night. But Sens. Ted Cruz, R-Texas, and Mike Lee, R-Utah, objected, prompting Sen. Bob Corker, R-Tenn., to accuse the Texas senator of trying to gin up publicity over the vote.

“I’m understanding the reason we’re waiting is that y’all have sent out [press releases] and e-mails and you want everybody to be able to watch,” Corker said. “It just doesn’t seem to me that that’s in our nation’s interest.”

Cruz turned the tables on Corker, saying the Tennessee senator’s vote on cloture on Friday will align with Democrats. Cloture is the procedure to bring a debate to a close, allowing a vote to take place.

“Why is Majority Leader Harry Reid going to vote the same way you’re proposing to vote? Why is every Democrat in this chamber going to vote the way you’re proposing to vote?” Cruz asked.

The fight highlighted a growing tension between many Republicans in the Senate and Cruz, whose 21-hour overnight speech in the Senate this week rankled some of his Republican colleagues.

Senate leadership wanted to move forward with the bill Thursday night to give the House more time to work on it and avoid a government shutdown, but Senate rules say a single senator can raise an objection to timing. While Reid placed the blame on Republicans for the stall, Corker pointed out that it was not all Republican senators who opposed the timing, just Cruz and Lee.

“It’s not the Republican side that’s asking to stall. We only have two Republican senators that are wanting to push this off,” he said.

The Senate will hold its final votes on the continuing resolution on Friday afternoon, sending the bill to the House over the weekend as a government shutdown looms on Oct 1.

U.S.-India summit comes as relations between the two languish

U.S.-India summit comes as relations between the two languish

Obama and Prime Minister Manmohan Singh meet Friday. A partnership that once seemed unlimited is now marked by frustration.

By Tanvi Sharma and Mark Magnier

September 27, 2013, 4:00 a.m.

NEW DELHI — Although economics, trade, security and nuclear energy will figure prominently when President Obama meets with Indian Prime Minister Manmohan Singh in Washington on Friday, the elephant in the room will be a growing disenchantment with a relationship once thought to have near-unlimited potential.

After a hard-fought battle in both countries to finalize the 2008 U.S.-Indian civil nuclear agreement — essentially allowing India to regain full international standing after it was sanctioned for testing nuclear devices in 1974 and 1998 — many on both sides of the Pacific expected ties to strengthen.

But instead frustration has mounted since then. The U.S. has bridled at India's perceived unwillingness to open markets, provide adequate support on international crises or cut through red tape and settle tax and protectionist issues.

India, meanwhile, is bothered by what it sees as a sense of entitlement among U.S. companies to the lion's share of nuclear and defense contracts because of closer political ties. New Delhi, which is seeking a seat on the U.N. Security Council, also feels it's being unfairly viewed as a regional counterweight to China when it's focused on more pressing domestic issues.

"I feel there is a kind of slackening of tempo in India-U.S. relations," said Salman Haider, a New Delhi-based analyst and a former Indian foreign secretary. "A top-level reaffirmation is desirable."

Few deals are expected to result from Friday's summit, the third between the U.S. and Indian leaders in four years, especially at a time when concessions are difficult because of India's upcoming general election. Singh turned 81 on Thursday, and this is likely to be his last official meeting with Obama, said Vinod Kumar, an analyst with New Delhi's Institute for Defense Studies and Analyses.

That said, the two sides appear keen to show at least modest progress, with an agreement expected between Nuclear Power Corp. of India and Westinghouse Electric Corp. to build reactors in India's northwestern Gujarat state.

The U.S. will be looking for reassurance that India is tackling its economic woes. In recent months, India's currency has depreciated, and the country has seen worsening fiscal and current account deficits, volatile markets, more capital controls and greater protectionism.

Though many developing countries have faced problems as international capital has gravitated toward the relatively robust U.S. market, India's problems are made worse by political infighting, policy drift and massive corruption scandals, all of which have helped undermine consumer and investor confidence.

U.S. companies in particular are unhappy with requirements that a significant portion of their exports to India include content made by local companies. Also bothersome, they say, are uncertainty over taxation and restrictions on foreign companies investing in the Indian pension and insurance sectors.

"There is very little the prime minister can do personally to change any of this," said Milan Vaishnav, an analyst with Washington's Carnegie Endowment for International Peace. "But they at least want some reassurance that the government hears their concerns and is willing to take some remedial steps to address them."

India, meanwhile, will probably be looking for assurance that it remains a central part of the U.S. strategic pivot toward the Asia-Pacific region. It will also look for better terms under America's H-1B visa program for foreign high-tech workers coming to or already in the United States. And, as the world's largest weapons importer, India seeks more joint design, development and production in defense projects.

Some in Washington wonder whether New Delhi actually wants significantly closer ties with the U.S. right now, even as India's allure as a rising power diminishes.

"All of this, combined with general elections around the corner, mean that American expectations are low," said Dhruva Jaishankar, a fellow with the German Marshall Fund of the United States in Washington. "The perception of economic turnaround would, however, change a lot."

Both sides are also likely to discuss India's neighbor Afghanistan, where U.S.-led NATO combat troops are preparing to withdraw by the end of 2014 amid concern that a resurgent Taliban could further destabilize the region.

Obama and Singh are also expected to discuss a proposed bilateral investment treaty. U.S. companies welcomed a recent Indian concession allowing commercial disputes to be settled by international arbitration rather than through India's often creaky courts, but they still view economic reforms as too slow. India counters that it's moving at its own pace, and cites recently eased restrictions on foreign retailers.

Liability issues remain a major sticking point with the cornerstone civil nuclear deal, which allowed India to acquire nuclear fuel for civilian use from suppliers around the globe. Under a 2010 Indian law, foreign suppliers assume nearly unlimited liability for accidents.

Fresh in Indians' minds is the 1984 Bhopal gas tragedy, which killed from 2,200 to more than 8,000 people, and the perception that U.S.-based chemical firm Union Carbide shirked its responsibilities. U.S. companies counter that open-ended liability is unworkable and out of step with international norms.

mark.magnier@latimes.com

Chidambaram says favours cheap loans for exporters

Chidambaram says favours cheap loans for exporters

MUMBAI |

Fri Sep 27, 2013 4:27pm IST

(Reuters) - The finance ministry is in talks with the Reserve Bank of India (RBI) to make bank loans cheaper for exporters, Finance Minister P Chidambaram said on Friday, a move that could help reduce wide current account deficit by boosting export income.

Exporters have been lobbying to be included in a category of priority lending that guarantees easier access to bank credit and lower interest rates, a privilege usually reserved for agriculture and small businesses.

India's has the world's third largest current account deficit, a major factor in a recent rout of the rupee currency. Exports account for some 25 percent of GDP.

(Reporting by Mumbai Bureau; Writing by Krishna Das; Editing by Frank Jack Daniel)

Thursday, September 26, 2013

Feds could bring news of $100M in aid for Detroit

Feds could bring news of $100M in aid for Detroit

September 26, 2013

WASHINGTON — Obama administration officials could

announce Friday in Detroit that more than $100 million in federal and

private funds — some new money, some previously announced — will be made

available for demolitions, policing and transportation, a person with

knowledge of the officials’ scheduled meeting with state and local

leaders said Wednesday.

Two days before the summit, much of the agenda — as well as the list of all participants — remained a mystery, though some details have emerged.

Among the possibilities: a $20-million private-sector match for the $52 million in federal demolition funds Detroit received; $10 million in grants to beef up policing around schools; technical assistance from Washington in freeing up as much as $100 million in transportation funds that haven’t been put to use because the city hasn’t met the qualifications.

■ Rochelle Riley: Detroit emergency manager Kevyn Orr says it's time for state to run Belle Isle

■ Related: City asks Detroit bankruptcy judge to stay lawsuits involving 36th District Court

■ Full coverage: Detroit’s financial crisis

President Barack Obama’s administration is sending at least three cabinet officials — Housing and Urban Development Secretary Shaun Donovan; Attorney General Eric Holder, and Transportation Secretary Anthony Foxx — to the summit. They will meet with a group to include Gov. Rick Snyder, Detroit Mayor Dave Bing and emergency manager Kevyn Orr.

“I think they are sending in the cavalry,” said U.S. Sen. Carl Levin, a Democrat from Detroit, whose staff, the Free Press reported weeks ago, created a list of more than 200 programs through which the administration could find dollars to help Detroit. Levin said he expects the cabinet members to announce funds that have not been announced. He also said the visit is the first of many.

“These cabinet officers ... will do more than just planning and simply saying, ‘There’s going to be an effort made,’ ” he said. “In addition to describing the effort, which is a pretty serious one when you’ve got three cabinet officers, I’m hoping there will be some announcements made about specific grants, funds that have been found in existing programs that can be used.”

“We tried to identify every single program that might be a ... funding source,” said Levin, who is also expected to attend, along with Democratic U.S. Sen. Debbie Stabenow of Lansing and U.S. Reps. John Conyers of Detroit, John Dingell of Dearborn and Gary Peters of Bloomfield Township.

Detroit emergency manager Kevyn Orr said that one of the great things the feds could offer is technical assistance to a city with computer technology so outdated that much of the accounting is done by hand.

“If we as a city show we are capable of meeting conditions to get the aid, use the aid, account and report for the aid, different federal agencies … will feel comfortable giving us aid.

“We have $293 million administered through seven programs, and we’re not compliant,” he said.

Orr, who has floated the idea of hiring a firm just to ensure the city complies with regulations to get funds, cited the fire department in a specific example of how getting a grant and keeping a grant are two different things.

“We had a SAFER grant to hire 140 FTES” — or Full-Time Equivalents — in the fire department, he said. “But the grant has limitations on how much it will pay for overtime. So the administrator over at Fire has to sit there and make these calculations and entries for each FTE. It takes 20 minutes apiece, on average, for each person — three weeks, without the technology that could take the press of a button. If these were quarterly reports, that means a third of each quarter for an employee is spent on compliance. That’s one grant. Without technology, we’re actually putting a tremendous burden on both city operations and our own employees, who are trying. I’ve developed a great deal of respect and admiration for our employees. They’re trying to do their jobs with the tools that they have.”

Announced last Thursday, Friday’s meeting — the first large-scale gathering of federal officials with state and local leaders in response to Detroit’s bankruptcy — is expected to last from 11 a.m. to 1 p.m. and be held at Wayne State University. It will touch on blight eradication, public safety, transportation systems and the city’s capacity to use federal resources. The meeting is by invitation only and closed to the media, though there could be a briefing afterward.

With no wide-scale federal bailout coming, White House officials have been monitoring the city’s progress and offering to match local leaders with existing sources of aid through a series of meetings in Washington.

By the time three cabinet members, an economic adviser and their staffs finish meeting Friday with local leaders and stakeholders, they plan to announce new monies and improved ways of ensuring that Detroit gets and spends the more than $200 million it is awarded in federal grants each year.

Much of that money goes unspent because the city fails to comply with rules for handling it.

Rep. John Dingell, D-Dearborn, said the meeting is part fact-finding and part relationship-building.

“They want to establish a working relationship with folks in Detroit. ... They also want to show ... that the administration wants to support the city.”

Detroit is the largest city in U.S. history to file for bankruptcy. Federal officials are to meet Friday with state and local leaders about a response to the city's financial crisis. / Carlos Osorio/Associated Press

Two days before the summit, much of the agenda — as well as the list of all participants — remained a mystery, though some details have emerged.

Among the possibilities: a $20-million private-sector match for the $52 million in federal demolition funds Detroit received; $10 million in grants to beef up policing around schools; technical assistance from Washington in freeing up as much as $100 million in transportation funds that haven’t been put to use because the city hasn’t met the qualifications.

■ Rochelle Riley: Detroit emergency manager Kevyn Orr says it's time for state to run Belle Isle

■ Related: City asks Detroit bankruptcy judge to stay lawsuits involving 36th District Court

■ Full coverage: Detroit’s financial crisis

President Barack Obama’s administration is sending at least three cabinet officials — Housing and Urban Development Secretary Shaun Donovan; Attorney General Eric Holder, and Transportation Secretary Anthony Foxx — to the summit. They will meet with a group to include Gov. Rick Snyder, Detroit Mayor Dave Bing and emergency manager Kevyn Orr.

“I think they are sending in the cavalry,” said U.S. Sen. Carl Levin, a Democrat from Detroit, whose staff, the Free Press reported weeks ago, created a list of more than 200 programs through which the administration could find dollars to help Detroit. Levin said he expects the cabinet members to announce funds that have not been announced. He also said the visit is the first of many.

“These cabinet officers ... will do more than just planning and simply saying, ‘There’s going to be an effort made,’ ” he said. “In addition to describing the effort, which is a pretty serious one when you’ve got three cabinet officers, I’m hoping there will be some announcements made about specific grants, funds that have been found in existing programs that can be used.”

“We tried to identify every single program that might be a ... funding source,” said Levin, who is also expected to attend, along with Democratic U.S. Sen. Debbie Stabenow of Lansing and U.S. Reps. John Conyers of Detroit, John Dingell of Dearborn and Gary Peters of Bloomfield Township.

Detroit emergency manager Kevyn Orr said that one of the great things the feds could offer is technical assistance to a city with computer technology so outdated that much of the accounting is done by hand.

“If we as a city show we are capable of meeting conditions to get the aid, use the aid, account and report for the aid, different federal agencies … will feel comfortable giving us aid.

“We have $293 million administered through seven programs, and we’re not compliant,” he said.

Orr, who has floated the idea of hiring a firm just to ensure the city complies with regulations to get funds, cited the fire department in a specific example of how getting a grant and keeping a grant are two different things.

“We had a SAFER grant to hire 140 FTES” — or Full-Time Equivalents — in the fire department, he said. “But the grant has limitations on how much it will pay for overtime. So the administrator over at Fire has to sit there and make these calculations and entries for each FTE. It takes 20 minutes apiece, on average, for each person — three weeks, without the technology that could take the press of a button. If these were quarterly reports, that means a third of each quarter for an employee is spent on compliance. That’s one grant. Without technology, we’re actually putting a tremendous burden on both city operations and our own employees, who are trying. I’ve developed a great deal of respect and admiration for our employees. They’re trying to do their jobs with the tools that they have.”

Announced last Thursday, Friday’s meeting — the first large-scale gathering of federal officials with state and local leaders in response to Detroit’s bankruptcy — is expected to last from 11 a.m. to 1 p.m. and be held at Wayne State University. It will touch on blight eradication, public safety, transportation systems and the city’s capacity to use federal resources. The meeting is by invitation only and closed to the media, though there could be a briefing afterward.

With no wide-scale federal bailout coming, White House officials have been monitoring the city’s progress and offering to match local leaders with existing sources of aid through a series of meetings in Washington.

By the time three cabinet members, an economic adviser and their staffs finish meeting Friday with local leaders and stakeholders, they plan to announce new monies and improved ways of ensuring that Detroit gets and spends the more than $200 million it is awarded in federal grants each year.

Much of that money goes unspent because the city fails to comply with rules for handling it.

Rep. John Dingell, D-Dearborn, said the meeting is part fact-finding and part relationship-building.

“They want to establish a working relationship with folks in Detroit. ... They also want to show ... that the administration wants to support the city.”

The city of Detroit has now officially filed for bankruptcy.

But Detroit was once the fourth-largest city in America, and in 1960 Detroit had the highest per-capita income in the entire nation. Below are nine facts with accompanying pictures of Detroit (in its heyday and presently) that show just what happens when a city slides into economic ruin.

1) $18.5 billion

That’s how much debt Detroit has piled up. If the city does go into bankruptcy, there’s been talk of selling off at least $2.5 billion in artwork held by the Detroit Institute of Arts to pay off creditors.

- See more at: http://washingtoncouldlearnalot.com/2013/06/detroit-in-nine-facts/#sthash.4nRPUbM3.dpuf

But Detroit was once the fourth-largest city in America, and in 1960 Detroit had the highest per-capita income in the entire nation. Below are nine facts with accompanying pictures of Detroit (in its heyday and presently) that show just what happens when a city slides into economic ruin.

1) $18.5 billion

That’s how much debt Detroit has piled up. If the city does go into bankruptcy, there’s been talk of selling off at least $2.5 billion in artwork held by the Detroit Institute of Arts to pay off creditors.

- See more at: http://washingtoncouldlearnalot.com/2013/06/detroit-in-nine-facts/#sthash.4nRPUbM3.dpuf

US has three weeks to raise debt limit–or risk default

US has three weeks to raise debt limit–or risk default

Suzy Khimm, @SuzyKhimm

Unless Congress raises the country’s borrowing limit, the government

will run out of cash to pay its bills no later than October 17, putting

the country at imminent risk of default, the Treasury Department said.

The announcement of the deadline ramps up the pressure on lawmakers who are currently struggling to pass a short-term budget in the next six days to avoid a government shutdown. They are similarly at odds over the debt ceiling, but economists warn that breaching the debt limit would do much greater damage than a shutdown.

Given Congress’s ongoing deadlock over the short-term budget, there is no clear political path to raising the debt ceiling. That’s fueled fears of a default on Treasury debt—a virtually unprecedented event that’s expected to have devastating financial and economic consequences. Markets here and abroad would tank. Bondholders would demand higher interest rates for holding U.S. debt, which would raise borrowing costs for governments, businesses, and prospective homebuyers.

The government already hit its borrowing limit in May, but the Treasury Department has been able to use what it calls “extraordinary measures” to increase its borrowing capacity temporarily. Such measures, however, will be exhausted by mid-October, Treasury Secretary Jack Lew said, when the government will run out of money to make its legally obligated payments.

At that point, the government would have only $30 billion in cash on hand, while its daily expenditures “can be as high as $60 billion,” Lew wrote in a letter to House Speaker John Boehner. In other words, the government wouldn’t have enough money to pay its bills and would risk default every day thereafter.

The Treasury Department had previously estimated that it would have $50 billion in available cash in mid-October, but recent tax revenues were lower than expected.

Analysts also warn there could be additional, unforeseen consequences for the event of a U.S. default over the debt limit. “Nobody knows what will happen because we’ve never done this before, and it’s extremely rare of great nations to not pay their own debts on time,” says Steve Bell of the Bipartisan Policy Center. “This would be a black swan event, and it’s going to happen at one of the worst possible times, coming in the wake of a great financial calamity called the Great Recession.”

While a government shutdown could change Congress’s political calculus over the debt ceiling, practically speaking, it would do little to affect the October 17 deadline. A shutdown would halt paychecks to government employees, military, and contractors. But those are only a fraction of the 80 million payments the Treasury makes every month to bondholders, Social Security beneficiaries, Medicare providers, veterans, and many others, Bell explained.

Especially if it’s brief, a shutdown wouldn’t buy Congress any more time to deal with the debt ceiling. “It will be within the rounding error,” said Bill Hoagland of the Bipartisan Policy Center, a former Republican Senate budget aide.

Lew rejected the notion that the government could cushion the effects of default by deciding which payments to prioritize, as House Republicans proposed to do in a recent bill. ”Any plan to prioritize some payments over others is simply default by another name,” he said in the letter. “There is no way of knowing the damage any prioritization plan would have on our economy and financial markets.”

Congressional Republicans have continued threatening to use the debt ceiling as a negotiating chip. The House now plans to vote on a bill that would tie the borrowing limit to delaying Obamacare for a year, among other demands.

President Obama has refused to negotiate over the debt ceiling this time around. When he did so in 2011, the debt-ceiling deal that passed cut spending by $900 billion and resulted in the across-the-board sequestration cuts that he and his party have since condemned.

On the left, there’s also growing fear that negotiating over the debt ceiling a second time would enshrine the practice for future Congresses, putting the country’s economy and markets into a chronic, perilous state of uncertainty. In 2011, the brinksmanship around debt ceiling cost the government $1.3 billion that fiscal year in increased borrowing costs, according to the Government Accountability Office—and that was a scenario in which we avoided default. The Bipartisan Policy Center estimates that the 2011 negotiations will ultimately cost the country more than $19 billion over 10 years.

This time around, “it will cost at least that much, if we go up until the last second,” says Bell. Despite Obama’s vow not to bargain over the debt-ceiling, the tight timeframe and Republican demands make it increasingly likely for negotiations over the borrowing limit—which enables the government to pay the bills it’s already racked up and legally obligated to pay—to get lumped together with budget negotiations over the government’s future spending.

If Congress can’t pass a stopgap budget, known as a Continuing Resolution, by September 30, the government will shut down on October 1, and the government could default just 16 days later. “As a practical legislative matter it will become very difficult to solve the CR without in some way making progress or solving debt ceiling,” says Bell.

3:00 PM on 09/25/2013

Speaker

of the House John Boehner, R-Ohio, arrives for a news conference at the

Capitol, in Washington, Thursday, Sept. 12, 2013. (Photo by J. Scott

Applewhite/AP)

The announcement of the deadline ramps up the pressure on lawmakers who are currently struggling to pass a short-term budget in the next six days to avoid a government shutdown. They are similarly at odds over the debt ceiling, but economists warn that breaching the debt limit would do much greater damage than a shutdown.

Given Congress’s ongoing deadlock over the short-term budget, there is no clear political path to raising the debt ceiling. That’s fueled fears of a default on Treasury debt—a virtually unprecedented event that’s expected to have devastating financial and economic consequences. Markets here and abroad would tank. Bondholders would demand higher interest rates for holding U.S. debt, which would raise borrowing costs for governments, businesses, and prospective homebuyers.

The government already hit its borrowing limit in May, but the Treasury Department has been able to use what it calls “extraordinary measures” to increase its borrowing capacity temporarily. Such measures, however, will be exhausted by mid-October, Treasury Secretary Jack Lew said, when the government will run out of money to make its legally obligated payments.

At that point, the government would have only $30 billion in cash on hand, while its daily expenditures “can be as high as $60 billion,” Lew wrote in a letter to House Speaker John Boehner. In other words, the government wouldn’t have enough money to pay its bills and would risk default every day thereafter.

The Treasury Department had previously estimated that it would have $50 billion in available cash in mid-October, but recent tax revenues were lower than expected.

Analysts also warn there could be additional, unforeseen consequences for the event of a U.S. default over the debt limit. “Nobody knows what will happen because we’ve never done this before, and it’s extremely rare of great nations to not pay their own debts on time,” says Steve Bell of the Bipartisan Policy Center. “This would be a black swan event, and it’s going to happen at one of the worst possible times, coming in the wake of a great financial calamity called the Great Recession.”

While a government shutdown could change Congress’s political calculus over the debt ceiling, practically speaking, it would do little to affect the October 17 deadline. A shutdown would halt paychecks to government employees, military, and contractors. But those are only a fraction of the 80 million payments the Treasury makes every month to bondholders, Social Security beneficiaries, Medicare providers, veterans, and many others, Bell explained.

Especially if it’s brief, a shutdown wouldn’t buy Congress any more time to deal with the debt ceiling. “It will be within the rounding error,” said Bill Hoagland of the Bipartisan Policy Center, a former Republican Senate budget aide.

Lew rejected the notion that the government could cushion the effects of default by deciding which payments to prioritize, as House Republicans proposed to do in a recent bill. ”Any plan to prioritize some payments over others is simply default by another name,” he said in the letter. “There is no way of knowing the damage any prioritization plan would have on our economy and financial markets.”

Congressional Republicans have continued threatening to use the debt ceiling as a negotiating chip. The House now plans to vote on a bill that would tie the borrowing limit to delaying Obamacare for a year, among other demands.

President Obama has refused to negotiate over the debt ceiling this time around. When he did so in 2011, the debt-ceiling deal that passed cut spending by $900 billion and resulted in the across-the-board sequestration cuts that he and his party have since condemned.

On the left, there’s also growing fear that negotiating over the debt ceiling a second time would enshrine the practice for future Congresses, putting the country’s economy and markets into a chronic, perilous state of uncertainty. In 2011, the brinksmanship around debt ceiling cost the government $1.3 billion that fiscal year in increased borrowing costs, according to the Government Accountability Office—and that was a scenario in which we avoided default. The Bipartisan Policy Center estimates that the 2011 negotiations will ultimately cost the country more than $19 billion over 10 years.

This time around, “it will cost at least that much, if we go up until the last second,” says Bell. Despite Obama’s vow not to bargain over the debt-ceiling, the tight timeframe and Republican demands make it increasingly likely for negotiations over the borrowing limit—which enables the government to pay the bills it’s already racked up and legally obligated to pay—to get lumped together with budget negotiations over the government’s future spending.

If Congress can’t pass a stopgap budget, known as a Continuing Resolution, by September 30, the government will shut down on October 1, and the government could default just 16 days later. “As a practical legislative matter it will become very difficult to solve the CR without in some way making progress or solving debt ceiling,” says Bell.

Over half of UK company shares owned by foreign investors

Over half of UK company shares owned by foreign investors

26 September 2013 LondonlovesBiz

A whopping 53.2% of the UK’s quoted shares are now foreign-owned compared to 30.7% in 1998. The value of shares held by non-UK companies has soared from £460.9bn to £935.1bn.

However, the proportion of shares owned by UK investors has seen a drop over the last few years. Only 10.7% of the UK’s shares are still held by individual investors.

As of 2012, UK insurance companies held 6.2% of UK shares compared to 21.6% in 1998.

Also, UK pension funds now hold 4.7% of shares compared to 21.7% held in 1998.

The British taxpayer remains one of UK’s biggest shareholders with shareholdings valued at £42.6bn. This is a result of the government’s intervention in the banking collapse of 2008-09 where it injected money into RBS, Lloyds TSB and HBOS.

Nick Baird, the chief executive for UK Trade & Investment said: “These figures show that the UK remains a world-leading business destination as well as the growing confidence and trust that foreign investors have in UK businesses.”

A Confederation of British Industry spokesperson commented: “These figures show that the UK has been successful in attracting foreign investment, which is critical to our economic success.”

ONGC Videsh keen to buy oil, gas blocks in Tanzania

New Delhi, Sept 26:

ONGC Videsh Ltd, the overseas arm of state-owned Oil

and Natural Gas Corp, has expressed interest in bidding in the next

round of licensing for offshore and onshore oil/gas blocks in Tanzania.

The

matter came up for discussions between the Minister of State for

Commerce and Industry, D. Purandeswari,  and Tanzanian Industry and Trade

Minister, Abdallah O Kigoda, at Dar-es-Salaam yesterday.

and Tanzanian Industry and Trade

Minister, Abdallah O Kigoda, at Dar-es-Salaam yesterday.

and Tanzanian Industry and Trade

Minister, Abdallah O Kigoda, at Dar-es-Salaam yesterday.

and Tanzanian Industry and Trade

Minister, Abdallah O Kigoda, at Dar-es-Salaam yesterday.

Purandeswari is in the East African nation for the 3rd meeting of the Tanzania—India Joint Trade Committee.

“ONGC

Videsh Ltd has expressed interest for bidding in the 4th licensing

round for seven offshore and one onshore oil/gas blocks in Tanzania,” a

Commerce Ministry statement said today.

The move would help in strengthening cooperation between the countries in the field of oil and gas.

It

also said that both the ministers agreed to double the volume of

bilateral trade in the next two years and to reduce the trade imbalance,

which is currently in favour of India.

The bilateral trade between the countries stood at $2.12 billion in 2012.

Further, the Indian side has raised the issue of the ban on export of rough Tanzanite (a kind of stones) imposed by Tanzania.

“In

response to the Indian request for revoking the ban, the Tanzanian side

assured that the matter will be considered,” it said.

It

said that India has agreed to consider the Tanzanian request to

establish a Gemology Institute there and offered help in capacity

building by training master craftsmen.

Both the ministers felt that there is a huge untapped potential for increasing Indian investment in Tanzania.

“The Indian Minister raised the issue regarding high cost of resident/work permit by Tanzanian authorities,” it said.

Indian

companies are investing in Tanzania in various sectors including

agriculture, construction, financial services, manufacturing, mining,

tourism, telecommunications and transport.

From 1990 to June 2013, investment by Indian companies in Tanzania is estimated to be $1.91 billion.

India has also agreed to cooperate with Tanzania for rehabilitation and modernisation of the Tanzania Railway system, it added.

Subscribe to:

Comments (Atom)