Thursday, June 18, 2015

Sunday, June 7, 2015

Consumer confidence yet to translate into consumption: HUL

The uncertain global economic environment, inflation and intense competition pose challenges, says firm

Hindustan Unilever Ltd (HUL), the country’s largest consumer packaged goods company by sales, on Friday said while consumer confidence has increased, it has not translated into an improvement in market conditions for fast moving consumer goods (FMCG).

In its annual report for fiscal 2015, the maker of Dove, Lux, Kissan and Surfbrands said in the short term, the uncertain global economic environment, inflation and intense competition pose challenges, while in the medium-to-long term, secular trends based on rising incomes, aspirations and consumption levels are positive, and an opportunity for the FMCG sector.

India remains at the top in the Nielsen global consumer confidence index for the fourth quarter in a row as of March end. However, the confidence is yet to translate into consumption, said Nielsen.

Even falling prices have not led to consumers loosening their purse strings. Inflation has dropped sharply over the past 12 months from around 9% a year ago to sub-5% levels currently on the back of government measures such as muted minimum support price hikes, open market sales of cereals and steps to limit hoarding.

“Footfalls are still down when seen month-on-month. Improved consumer sentiments have yet not translated into spends. Consumers remain cautious,” said Amit Jatia, vice-chairman of Hardcastle Restaurants Pvt. Ltd, a joint venture partner of McDonald’s in India. “We have to be patient. When the economy will take off, we can’t say. The government has taken a lot of good steps.”

As such, despite lower inflation, price cuts and aggressive spending on advertising and promotions, HUL’s increase in volume growth was not spectacular in the March quarter.

The company sold 6% more by volume during the March quarter, compared with the 3% growth seen in the October-December period. Though higher in absolute terms, a low base effect is partly responsible for it and some analysts had pencilled in this level of growth in their estimates.

Moreover, a below-average monsoon this year can dent rural demand and further compound the stress in the FMCG sector.

“This year, we have seen unseasonal rains and even the forecast for the monsoon is not very promising. This will bring rural demand under pressure,” said Vivek Karve, chief financial officer at Marico Ltd.

Besides, inflation is firming up once again. Brent crude, a key raw material for the sector, had hit a low of $46.59 per barrel on 13 January 2015. Since then it has gained 47.48%. Food inflation will also be back if the “deficient” monsoon forecast plays out.

To tackle a slow-growth market, HUL has accelerated the pace of innovation in the past fiscal year. Innovations touching about 60% of the product portfolio were executed, the company said in its annual report.

It also came out with a slew of launches, including TRESemmé Split Remedy and Hair Spa Rejuvenation shampoos and Closeup Diamond Attraction, a premium whitening toothpaste. There were also a few launches targeting the male consumer—Axe Signature deodorant andPond’s Men Energy Charge face wash with coffee beans.

Given the tough macroeconomic environment, HUL has also been working on cost-savings programmes. During the fiscal year, it saved 5% in supply chain costs, which is driven by various cross-functional teams such as research and development, procurement, manufacturing and logistics.

The company continued to drive its rural penetration programme by creating a consumer contact programme aimed at accelerating the growth and adoption of small and emerging categories in villages.

Through the programme, it reached more than 2.5 million rural consumers and contacted 800,000 schoolchildren. This programme is now active in over 8,000 villages across the country, the company said.

HUL also changed its direct selling business model under Hindustan Unilever Network to an online ordering and fulfilment model as the year continued to prove to be extremely challenging for the entire direct selling industry. There is “ambiguity on acceptable norms for direct selling in India”, the company said by way of explanation for the change to online ordering.

HUL’s shares closed at Rs.829.85, up 0.89% on BSE even as the Sensex ended at 26,768.49 points, down 0.17% on Friday.

The everything creditor

Bad loans for sale in online auctions

FROM shoes to furniture and cosmetics to cars, shoppers in China can find just about anything on Taobao, the country’s biggest online marketplace. They now have one more category to choose from: distressed assets. Cinda, a state-owned bank set up to manage non-performing loans, will launch an auction on Taobao later this month of bad debts with a face value of 4 billion yuan ($646m)—backed by collateral such as bankrupt factories and even unused mines. As the economy slows, such debts are piling up. This innovative technique may help the state to offload some of them.

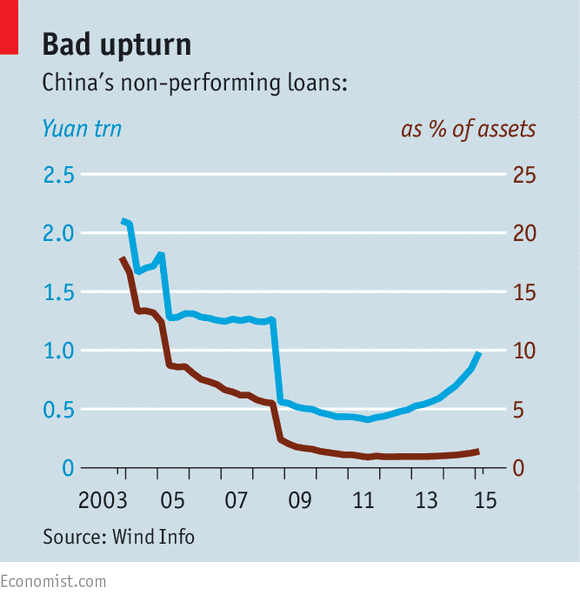

Bad loans in the Chinese banking system reached more than 982 billion yuan at the end of March, more than double their level three years earlier. Non-performing loans are only about 1.4% of the total on banks’ books, reportedly. But this ratio would have been higher were it not for banks shuffling off their dud loans to Cinda and China’s three other asset-management companies (AMCs).

Established 15 years ago, the AMCs were initially treated as an expedient way of cleaning up banks’ balance sheets. Bad loans accounted for about a quarter of banks’ assets at the time. The AMCs struggled to recoup much of their paper worth. But as economic growth surged, the assets increased in value (a bankrupt factory, for example, became a prized piece of real estate). So did the AMCs themselves. With the recent downturn in the economy, they have started to look for bad loans that might turn a profit. Last year Cinda bought some 149.5 billion yuan of distressed assets—two-thirds more than in 2013—from banks but also from property developers and industrial companies. It is now trying to recoup money from them, either by finding buyers willing to pay a higher price or by increasing their value through restructuring of the businesses.

The decision to sell some of the assets on Taobao, a website normally associated with consumer goods shipped in boxes, might seem odd. But Taobao, one of the main portals of Alibaba, China’s e-commerce giant, has operated an auction platform since 2012 for assets seized by courts. That site features luxury cars, parking spots, rare tea and more. A few banks have used it to auction repossessed homes.

China is not alone in trying to sell bad debts online. In America, dedicated auction websites for troubled real-estate assets grew rapidly after the global financial crisis. But the size of the Taobao sales is unusual. Cinda ran its first Taobao auction of non-performing loans as a small trial in March. It sold debts owed by a steel mill for 20m yuan and those of a cleaning-supplies company for 4.4m. With that success, Cinda judged that the market was strong enough for a much larger offering. Its big auction of assets will begin on June 20th. China’s other AMCs are expected to follow its lead by selling on Taobao as well. Savvy buyers should be able to find goodish debts at reasonable prices but also plenty of assets beyond salvation. They would do well to remember: caveat creditor.

Tuesday, June 2, 2015

Petrobras and ONGC find new oil reservoir off Brazil's Sergipe

Petrobras and ONGC find new oil reservoir off Brazil's Sergipe

BRASILIA

Brazil's state-run Petroleo Brasileiro SA (PETR4.SA) discovered a new deposit of light oil in deep waters off the coast of the northern state of Sergipe, the company said on Monday.

Well 3-SES-189, located in the Poço Verde area discovered in 2012 in the BM-SEAL-4 exploration block, was drilled down to 5,350 meters in waters 2,479 meters deep.

Drilling began on April 6 by Diamond Offshore Drilling Inc (DO.N) with its Ocean Courage semisubmersible rig.

"The reservoirs contain light oil of good market value and are 85 meters wide, with good porous and permeable conditions," a Petrobras statement said. It said another test is needed to confirm the conditions and establish the well's potential.

Petrobras is the operator and has a 75 percent stake in the prospect, in partnership with India's Oil and Natural Gas Corp (ONGC.NS), which holds 25 percent.

Deepwater exploration in the Sergipe-Alagoas Basin by Petrobras, ONGC and India's Videocon Industries Ltd and Bharat Petroleum Corp. has resulted in some of Brazil's largest oil discoveries outside the giant finds in the Santos Basin.

(Reporting by Anthony Boadle; Editing by Michael Perry)

Subscribe to:

Comments (Atom)