Bad loans for sale in online auctions

FROM shoes to furniture and cosmetics to cars, shoppers in China can find just about anything on Taobao, the country’s biggest online marketplace. They now have one more category to choose from: distressed assets. Cinda, a state-owned bank set up to manage non-performing loans, will launch an auction on Taobao later this month of bad debts with a face value of 4 billion yuan ($646m)—backed by collateral such as bankrupt factories and even unused mines. As the economy slows, such debts are piling up. This innovative technique may help the state to offload some of them.

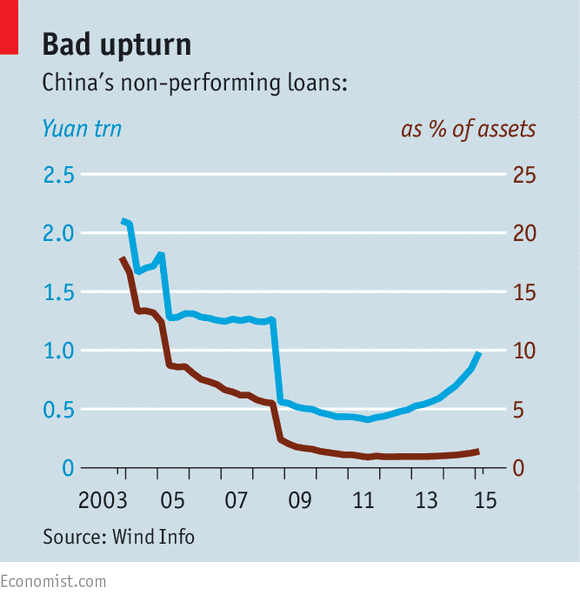

Bad loans in the Chinese banking system reached more than 982 billion yuan at the end of March, more than double their level three years earlier. Non-performing loans are only about 1.4% of the total on banks’ books, reportedly. But this ratio would have been higher were it not for banks shuffling off their dud loans to Cinda and China’s three other asset-management companies (AMCs).

Established 15 years ago, the AMCs were initially treated as an expedient way of cleaning up banks’ balance sheets. Bad loans accounted for about a quarter of banks’ assets at the time. The AMCs struggled to recoup much of their paper worth. But as economic growth surged, the assets increased in value (a bankrupt factory, for example, became a prized piece of real estate). So did the AMCs themselves. With the recent downturn in the economy, they have started to look for bad loans that might turn a profit. Last year Cinda bought some 149.5 billion yuan of distressed assets—two-thirds more than in 2013—from banks but also from property developers and industrial companies. It is now trying to recoup money from them, either by finding buyers willing to pay a higher price or by increasing their value through restructuring of the businesses.

The decision to sell some of the assets on Taobao, a website normally associated with consumer goods shipped in boxes, might seem odd. But Taobao, one of the main portals of Alibaba, China’s e-commerce giant, has operated an auction platform since 2012 for assets seized by courts. That site features luxury cars, parking spots, rare tea and more. A few banks have used it to auction repossessed homes.

China is not alone in trying to sell bad debts online. In America, dedicated auction websites for troubled real-estate assets grew rapidly after the global financial crisis. But the size of the Taobao sales is unusual. Cinda ran its first Taobao auction of non-performing loans as a small trial in March. It sold debts owed by a steel mill for 20m yuan and those of a cleaning-supplies company for 4.4m. With that success, Cinda judged that the market was strong enough for a much larger offering. Its big auction of assets will begin on June 20th. China’s other AMCs are expected to follow its lead by selling on Taobao as well. Savvy buyers should be able to find goodish debts at reasonable prices but also plenty of assets beyond salvation. They would do well to remember: caveat creditor.

epicresearch.co NCDEX Tips : BUY MENTHA OIL JUNE ABOVE 1000 TARGET 1004 1009 1015 SL BELOW 995

ReplyDelete